Ford Motor Company (NYSE:F) A Stock Worth Watching – Live Trading News

$F #Ford #Earnings #USA #NYSE #Auto #Manufactures #Stocks #Trading

Ford

Ticker: NYSE:F

Price: $8.52

Company News

A cost-cutting deal called “pivotal” by Ford in 2019 has gone kaput, the automaker announced just after the stock market closed on New Year’s Eve.

It was a quiet but dramatic turn of events for Ford that potentially carries financial consequences in 2021 and throws into question Ford operations in India. Ford loses money in all markets in the world except North America.

Ford said at the time that it had inked a deal with Mahindra that would shift Ford’s long-struggling India operation to a new joint venture valued at $275 million and “develop, market and distribute Ford brand vehicles in India and Ford brand and Mahindra brand vehicles in high-growth emerging markets around the world.”

Ford’s Jim Farley, then-president of new businesses, technology and strategy and now CEO, flew to India for the announcement and called the development “a pivotal moment in our company’s history.”

Farley praised Mahindra for its cost efficiency and said in 2019, “Together, we feel we can create a strong and competitive powerhouse. Our new joint venture will allow Ford not just to sustain our business in India” but to profitably grow it there.

Ford said in 2019 that “the joint venture expects to introduce three new utility vehicles under the Ford brand, beginning with a new midsize sports utility vehicle that will have a common Mahindra product platform and powertrain.”

It also said Ford and Mahindra would collaborate to develop electric vehicles “to support the growth of sustainable mobility across emerging markets.”

When asked Monday about how dissolution of the deal impacts product development, Thibodeau said Ford has no additional information to provide.

Ford has been manufacturing in India for the past 25 years, after taking a decades-long break in the densely populated country with low labor costs. The company has two assembly plants in Sanand and Chennai, which exports the EcoSport to the U.S., another engine plant in Sanand, and offices in Delhi and Coimbatore, Ford confirmed Monday. It employs about 14,000 people in India.

Never mind

But last week, Ford disclosed in its news release that “fundamental changes in global economic and business conditions — caused, in part, by the global COVID-19 pandemic — over the past 15 months” had changed the landscape. “Those changes influenced separate decisions by Ford and Mahindra to reassess their respective capital allocation priorities.”

The timing of the decision, Ford said, simply dovetailed with the expiration date of the agreement the two companies entered into in October 2019.

Ford’s independent operations in India “will continue as is” while the company “actively” evaluates its business worldwide, including India.

In announcing the fizzled joint venture plan, Ford said it plans to:

- “Turn around its automotive business — competing like a challenger while simplifying and modernizing all aspects of the company.”

- “Grow by capitalizing on existing strengths, disrupting the conventional automotive business, and partnering with others to gain expertise and efficiency.”

This shift with Mahindra seems to fly in the face of actions that earned praise from analysts in 2019, who noted Ford had sunk $2 billion into India with little return — a tiny market share hovering around 3%.

Business Summary

Ford Motor Company is a global automotive and mobility company.

The Company’s business includes designing, manufacturing, marketing, and servicing a full line of Ford cars, trucks, and sport utility vehicles (SUVs), as well as Lincoln luxury vehicles.

The Company operates in four segments: Automotive, Financial Services, Ford Smart Mobility LLC, and Central Treasury Operations.

The Automotive segment primarily includes the sale of Ford and Lincoln brand vehicles, service parts, and accessories across the world.

The Financial Services segment primarily includes its vehicle-related financing and leasing activities at Ford Motor Credit Company LLC. Ford Smart Mobility LLC is a subsidiary formed to design, build, grow, and invest in emerging mobility services.

The Central Treasury Operations segment is primarily engaged in decision making for investments, risk management activities, and providing financing for the Automotive segment.

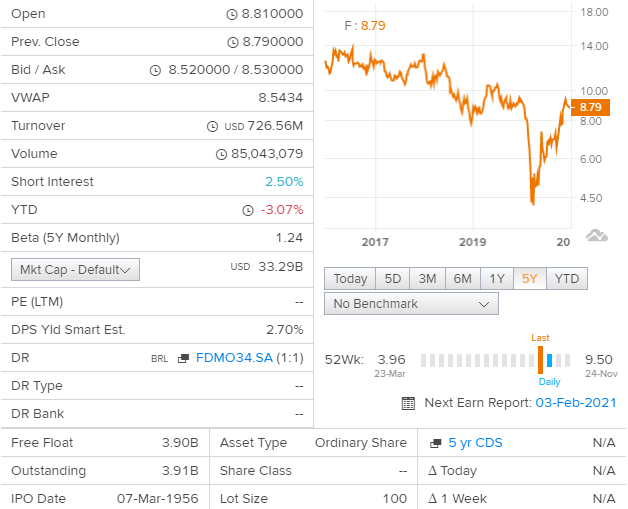

Price Performance

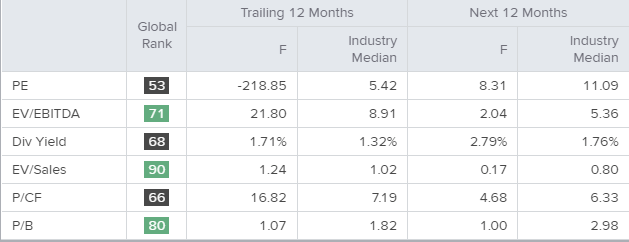

Relative Valuation

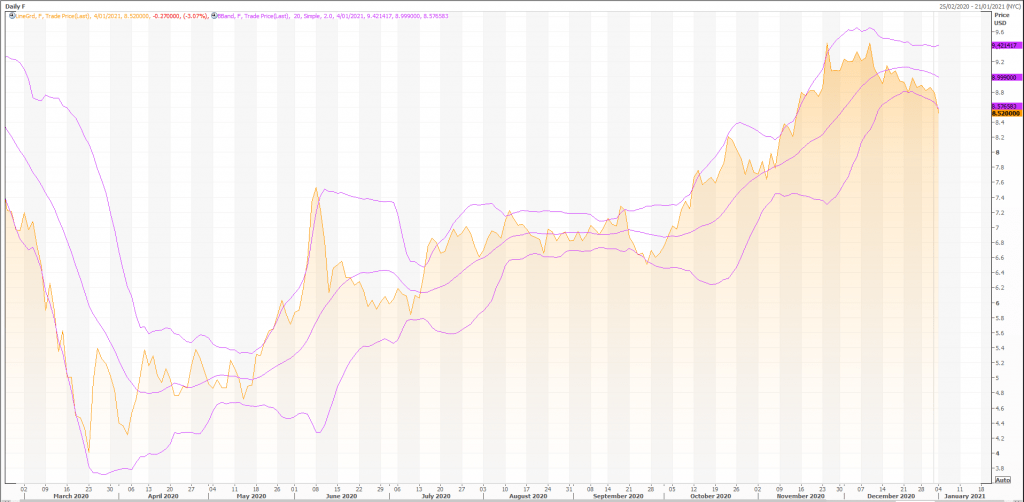

Technical Indicators

Overall, the bias in prices is: Upwards.

The projected upper bound is: 9.12.

The projected lower bound is: 7.95.

The projected closing price is: 8.53.

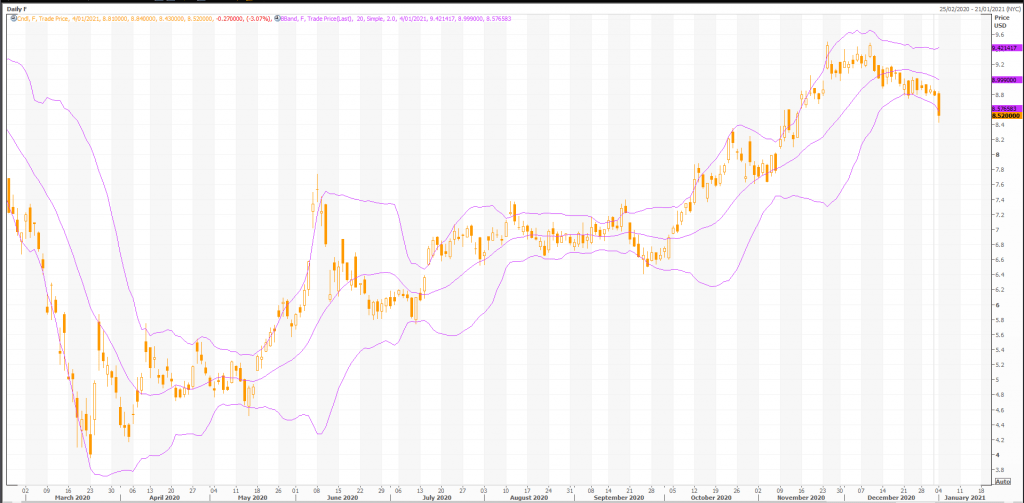

Candlesticks

A big black candle occurred. This is bearish, as prices closed significantly lower than they opened. If the candle appears when prices are “high,” it may be the first sign of a top. If it occurs when prices are confronting an overhead resistance area (e.g., a moving average, trendline, or price resistance level), the long black candle adds credibility to the resistance. Similarly, if the candle appears as prices break below a support area, the long black candle confirms the failure of the support area.

During the past 10 bars, there have been 3 white candles and 7 black candles for a net of 4 black candles. During the past 50 bars, there have been 20 white candles and 29 black candles for a net of 9 black candles.

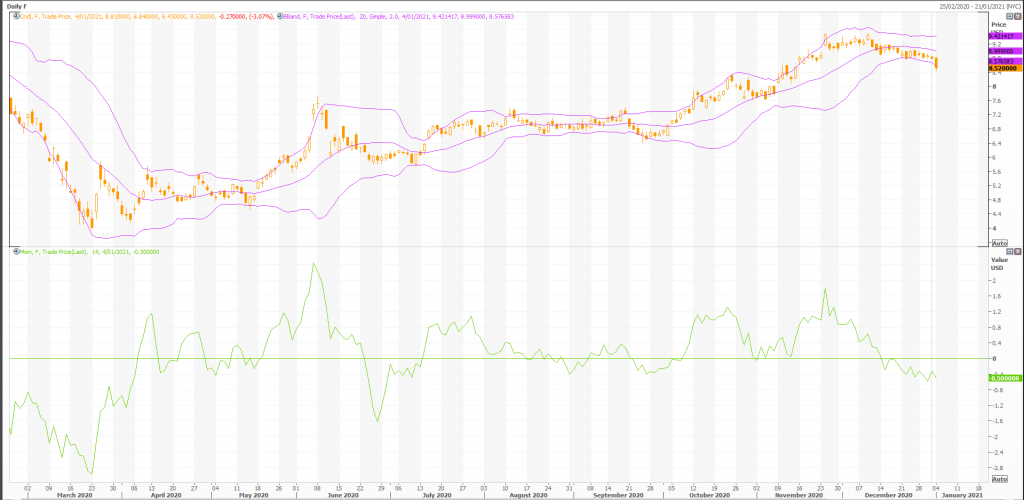

Momentum Indicators

Momentum is a general term used to describe the speed at which prices move over a given time period. Generally, changes in momentum tend to lead to changes in prices. This expert shows the current values of four popular momentum indicators.

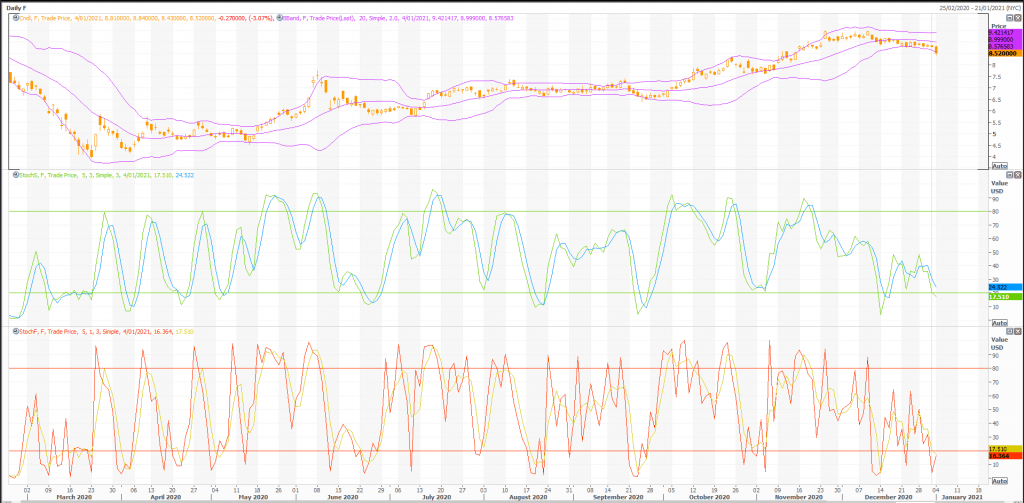

Stochastic Oscillator

One method of interpreting the Stochastic Oscillator is looking for overbought areas (above 80) and oversold areas (below 20). The Stochastic Oscillator is 17.2414. This is an oversold reading. However, a signal is not generated until the Oscillator crosses above 20 The last signal was a buy 11 period(s) ago.

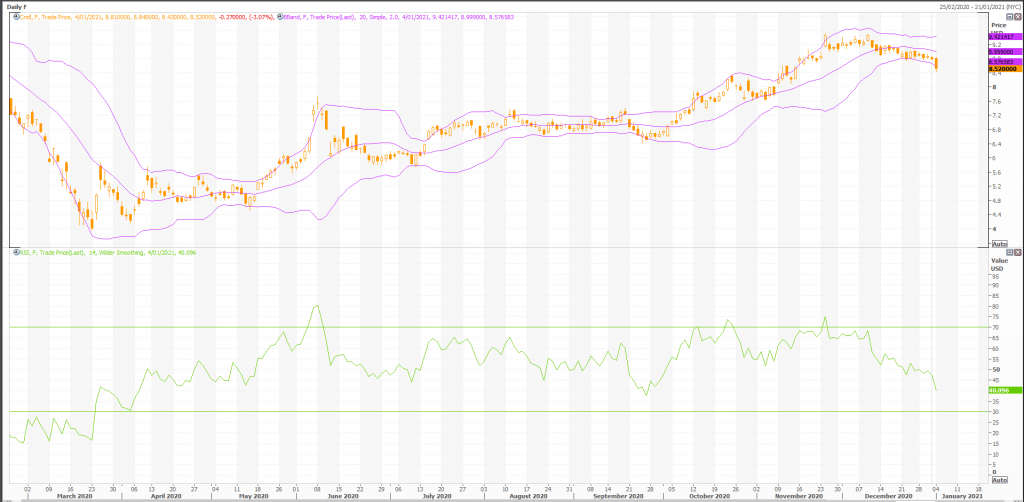

Relative Strength Index (RSI)

The RSI shows overbought (above 70) and oversold (below 30) areas. The current value of the RSI is 40.10. This is not a topping or bottoming area. A buy or sell signal is generated when the RSI moves out of an overbought/oversold area. The last signal was a sell 25 period(s) ago.

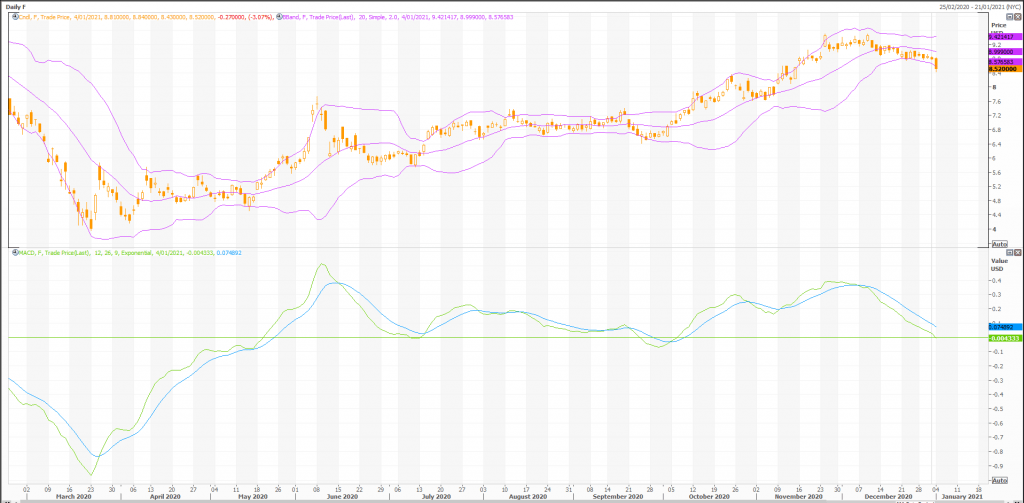

MACD

The Moving Average Convergence/Divergence indicator (MACD) gives signals when it crosses its 9 period signal line. The last signal was a sell 20 period(s) ago.

Rex Takasugi – TD Profile

FORD MOTOR CO closed down -0.270 at 8.520. Volume was 9% above average (neutral) and Bollinger Bands were 20% narrower than normal.

Open High Low Close Volume 8.810 8.840 8.430 8.520 14,085,289 Technical Outlook Short Term: Oversold Intermediate Term: Bearish Long Term: Bullish Moving Averages: 10-period 50-period 200-period Close: 8.84 8.67 6.83 Volatility: 26 44 65 Volume: 11,776,018 13,153,972 15,401,901

Short-term traders should pay closer attention to buy/sell arrows while intermediate/long-term traders should place greater emphasis on the Bullish or Bearish trend reflected in the lower ribbon.

Summary

FORD MOTOR CO is currently 24.8% above its 200-period moving average and is in an downward trend. Volatility is low as compared to the average volatility over the last 10 periods.

Our volume indicators reflect volume flowing into and out of F.N at a relatively equal pace (neutral). Our trend forecasting oscillators are currently bearish on F.N and have had this outlook for the last 6 periods.