British Pound: GBP/USD (GBP=X) Recovery Survives Trump Virus Shock – Live Trading News

British Pound Outlook

The Pound to Dollar exchange rate recovered further lost ground last week but is still susceptible to adverse Brexit headlines and could also face downside risks amid fears for the health of President Donald Trump over the coming days.

President Trump is battling against the coronavirus after testing positive for it on Friday, threatening markets with weeks of uncertainty about whether he’ll be able to compete in November’s election.

Sterling has been trading in a 1.27-to-1.30 range and was boosted Friday when political leaders instructed Brexit negotiators to work more intensively to bridge remaining differences in the trade negotiations.

There had been fears that either the EU or UK could walk away from the table if a deal had not come together by October and if EU objections to the Internal Market Bill remained unaddressed, but the two sides are now expected to continue talking beyond a self-imposed mid-month deadline if necessary.

We remain highly skeptical of apparent progress/breakthroughs in negotiations as the two sides remain far apart on key issues with less than two weeks to go until the Oct 15-16 EU leaders’ summit. Brexit headlines will remain the main trigger for GBP price swings in the near term. A close today above its 21-day MA of 1.2896 would be the first in four weeks and could signal further gains. On the weekly charts its 200-week MA at 1.2935 will stand as resistance.

With updates on Trump’s health condition and Brexit aside, Sterling and the Dollar will take direction this week from a Tuesday speech by Federal Reserve Chairman Jerome Powell that will focus on the U.S. economic outlook and a Thursday address from Bank of England Governor Andrew Bailey.

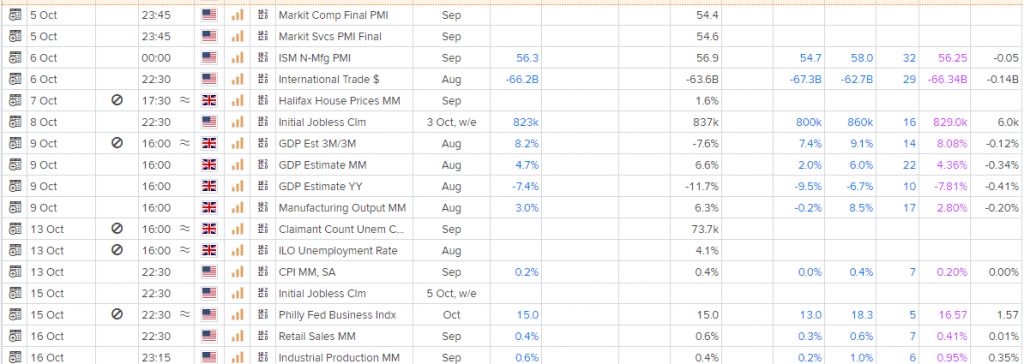

Tuesday’s 15:00 Institute for Supply Management (ISM) services PMI will also be scrutinised for clues on the health of the U.S. economy in September, while Friday’s August GDP data from the UK will also be in focus.

The August GDP reading will be an important one for the Bank, if it is to meet its 20% q-o-q projection. Yes, spending has continued to rise into August. But the pace of rising activity has slowed. The Chancellor’s Eat Out to Help Out Scheme will likely prop up GDP by around 2.5% alone through a boost to food & accommodation activity. Other service industries, however, will likely show a drop in growth…All told, this should see August GDP rise by around 4.1% m-o-m, bringing the UK economy to just around 92% of its pre-virus levels.

GBP/US Dollar Exchange Rate

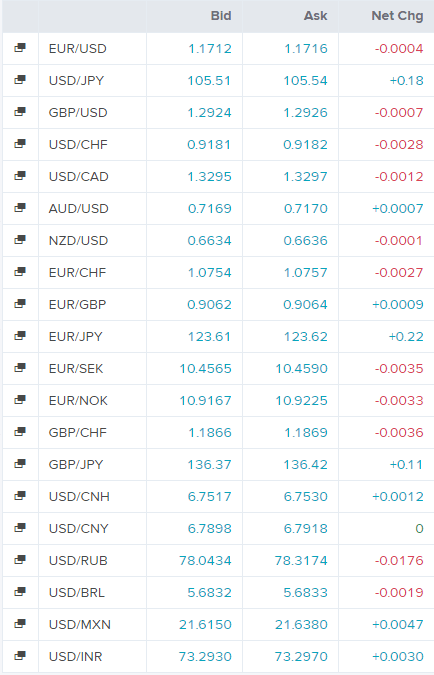

Today’s Forex Rates

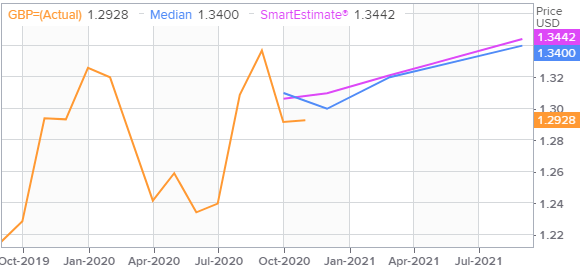

GBP/US Dollar FX Polls

Economic Events

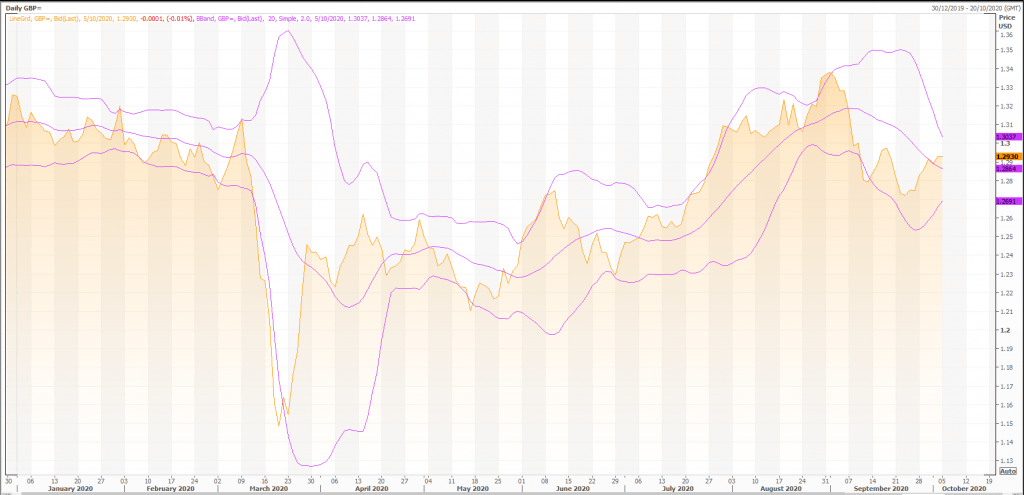

Technical Indicators

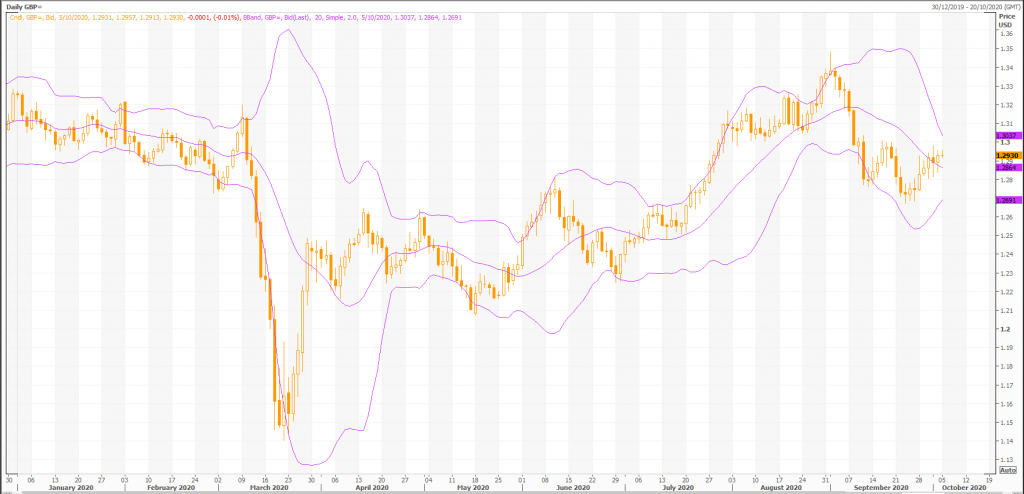

Overall, the bias in prices is: Sideways.

The projected upper bound is: 1.32.

The projected lower bound is: 1.27.

The projected closing price is: 1.29.

Candlesticks

A white body occurred (because prices closed higher than they opened).

During the past 10 bars, there have been 6 white candles and 4 black candles for a net of 2 white candles. During the past 50 bars, there have been 28 white candles and 22 black candles for a net of 6 white candles.

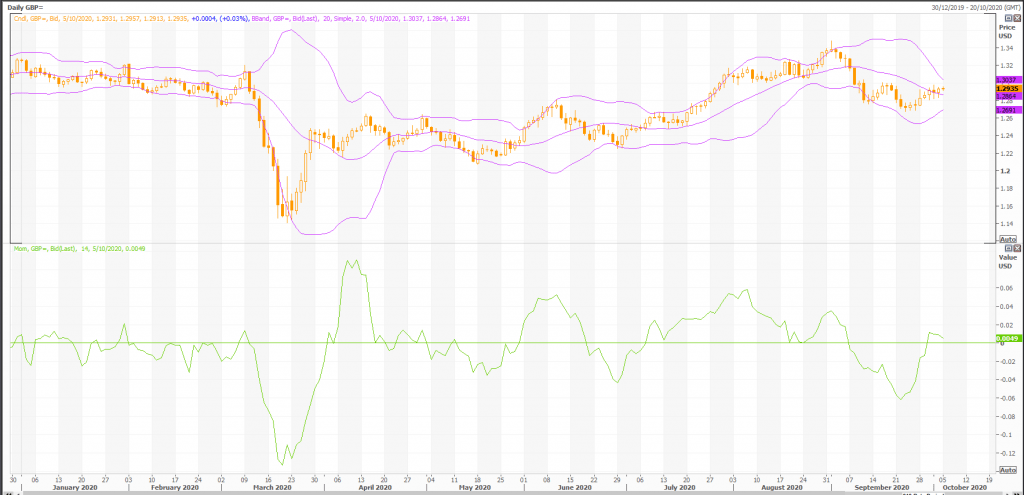

Momentum Indicators

Momentum is a general term used to describe the speed at which prices move over a given time period. Generally, changes in momentum tend to lead to changes in prices. This expert shows the current values of four popular momentum indicators.

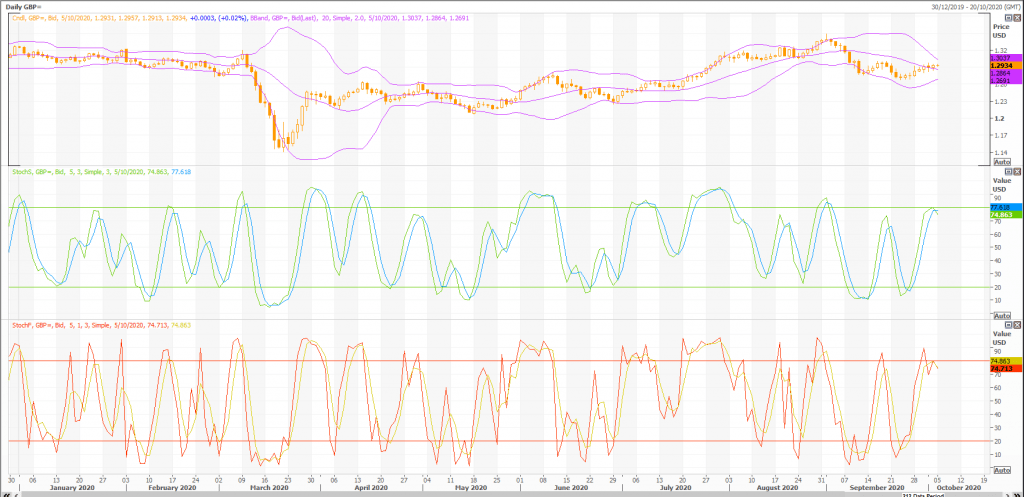

Stochastic Oscillator

One method of interpreting the Stochastic Oscillator is looking for overbought areas (above 80) and oversold areas (below 20). The Stochastic Oscillator is 74.3265. This is not an overbought or oversold reading. The last signal was a buy 6 period(s) ago.

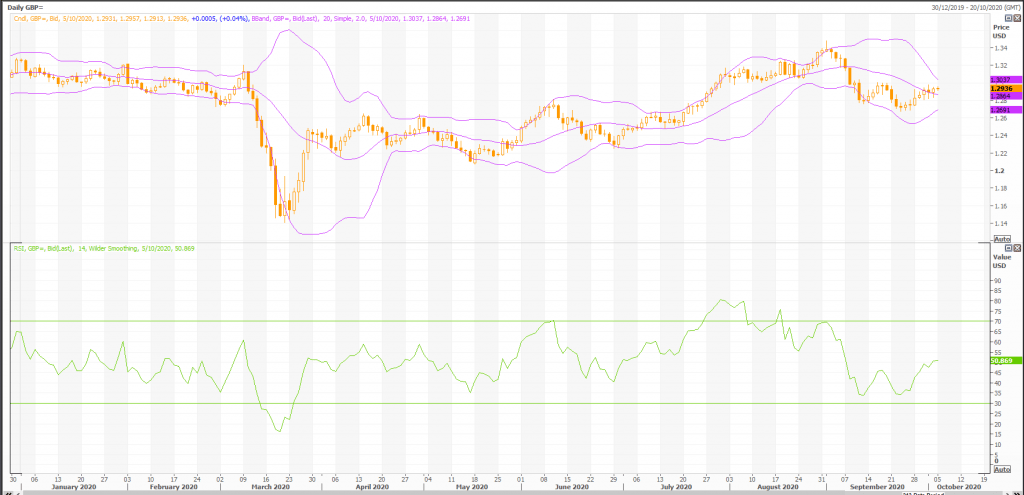

Relative Strength Index (RSI)

The RSI shows overbought (above 70) and oversold (below 30) areas. The current value of the RSI is 50.65. This is not a topping or bottoming area. A buy or sell signal is generated when the RSI moves out of an overbought/oversold area. The last signal was a sell 33 period(s) ago.

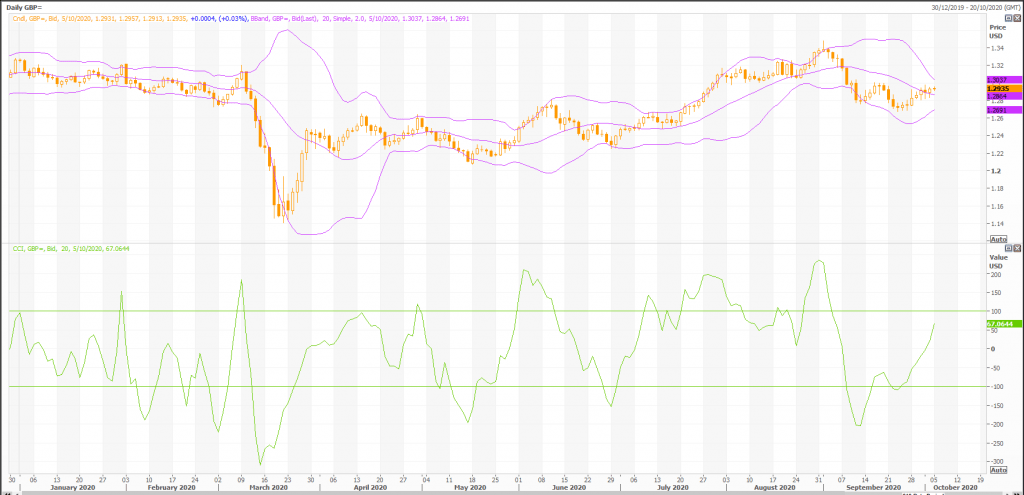

Commodity Channel Index (CCI)

The CCI shows overbought (above 100) and oversold (below -100) areas. The current value of the CCI is 78. This is not a topping or bottoming area. The last signal was a buy 6 period(s) ago.

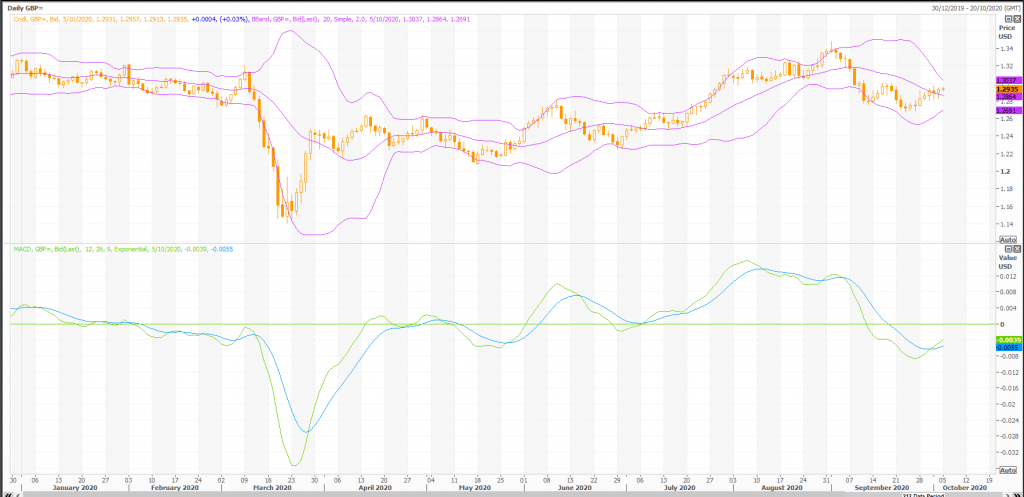

MACD

The Moving Average Convergence/Divergence indicator (MACD) gives signals when it crosses its 9 period signal line. The last signal was a buy 3 period(s) ago.

Rex Takasugi – TD Profile

FOREX GBP= closed up 0.000 at 1.293. Volume was 95% below average (consolidating) and Bollinger Bands were 40% narrower than normal.

Open High Low Close Volume 1.293 1.296 1.291 1.293 6,940 Technical Outlook Short Term: Neutral Intermediate Term: Bearish Long Term: Bullish Moving Averages: 10-period 50-period 200-period Close: 1.28 1.30 1.27 Volatility: 7 11 14 Volume: 144,919 126,175 124,744

Short-term traders should pay closer attention to buy/sell arrows while intermediate/long-term traders should place greater emphasis on the Bullish or Bearish trend reflected in the lower ribbon.

Summary

FOREX GBP= is currently 1.7% above its 200-period moving average and is in an downward trend. Volatility is high as compared to the average volatility over the last 10 periods.

Our volume indicators reflect volume flowing into and out of GBP= at a relatively equal pace (neutral). Our trend forecasting oscillators are currently bearish on GBP= and have had this outlook for the last 18 periods. Our momentum oscillator has set a new 14-period high while the security price has not. This is a bullish divergence.